Unlevered : describes any financial indicator calculated after neutralizing the effect of financial debt. For example, unlevered net income is equivalent to net operating profit after tax (NOPAT). Or, the unlevered enterprise value is equivalent to shareholders' equity value in the absence of financial debt and non-operational assets..

APV approach : the adjusted present value approach corrects cash flow forecasts for several kinds of risk, particularly the one resulting from debt, rather than adjusting the discount rate. For example, in order to account for financial debt,

unlevered cash flow is increased to reflect the positive effect of tax-shield savings and decreased by the negative effects of: i) the systematic cost of leverage (SCL); and ii) the expected cost of default(LCD). See

methodological note 5.

Beta: in the sense of the capital asset pricing model

(CAPM) the beta, β, or systematic risk coefficient, is the variable that determines the expected return for a risky financial asset. Each sector beta provided on our website is calculated on the basis of the sector portfolio's monthly returns over the past three years. These returns correspond to the average returns of the companies in the portfolio, weighted by the prevailing market capitalization before calculating each price change.

See note 6 (to be published).

Cost of debt:

kD refers to the rate a company pays, at a given time, to borrow from credit institutions or to issue debt securities on the markets. It can be broken down into a risk-free rate and a spread that reflect the financial risk of the company.

Fairness Finance's estimate of the cost of debt consists of regressing yields to maturity observed at a given date for a large number of listed fixed-rate

in fine bonds, with financial risk indicators (in particular the credit rating of the bond), the size of the company and the residual maturity of the instrument (see

methological note 7).

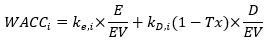

When calculating a weighted average cost of capital, the cost of debt must be adjusted of interest deductibility by calculating a cost of debt after tax (see

WACC).

Cost of equity :

ke refers to the rate of return required, at a given time, by shareholders to invest in a company. In accordance with the

CAPM, it must ensure the remuneration of the systematic risk of the investment through a risk premium adjusted by a Beta. The sum of this adjusted premium and the risk-free rate represents the expected return on investment,

E(ke). This rate is also an opportunity cost for the investor, and therefore a discount rate.

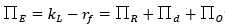

However, such a rate is only suitable if the cash flow forecasts are mathematical expectations. Generally, these are conditional expectations in case of survival, and are subject to an optimism bias. To correct these biases, the cash flows can be reduced to take into account the probabilistic losses in case of default and the optimism bias. The alternative, more commonly used, is to correct the forecasting bias via the discount rate, by increasing the expectation of return on equity,

E(ke), of a

premium for optimism bias ΠO and a

default risk premium Πd. The cost of equity thus calculated is qualified as conditional, to mark the fact that it is different (generally superior) to the expected return, and that it is intended only to establish a discount rate adapted to the forecasts of a business plan.

Unlevered beta : deducted from the

beta of a listed share (which is affected by the company's leverage) by applying the Robert Hamada formula (1972) that links the company's leverage and the systematic risk of its stock. For companies with surplus cash, this cash is considered a risk-free asset, distributable after tax.

See notes

n° 5 and n° 6 (to be published).

Financial leverage : quotient of the value of the net financial debt, recognized in the balance sheet, relative to the market value of the company's shareholders equity. It can also be measured by comparing the net financial debt to the enterprise value (EV), which is estimated by adding the net financial debt and the market value of equity (see

WACC below). .

If the debt arises from fully consolidated accounts, the value of minority interests should be taken into account when estimating the total value of equity.

Forecast biases : according to the

CAPM, forecast cash flows contributing to expected stock returns are mathematical expectations. However, the cash flow forecasts available to us are almost exclusively conditional expectations in the event of companies' survival. Therefore, they do not take into account any/sufficient probabilities of default, which are negligible only for a tiny minority (benefiting from the equivalent of an AAA rating). On the other hand, forecasts in the case of company's survival are themselves tainted by an optimistic bias. This explains why the the

expected market return is less than the

implied cost of capital that we calculate, to correct these forecast biases

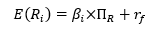

CAPM/MEDAF : the capital asset pricing model defines the return expectancy of a risky financial security,

E(Ri), by a linear relationship in which its

beta,

βi, is the explanatory variable, the

CAPM risk premium,

ΠR, the slope and the

risk free rate,

rf, is the intercept :

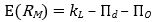

It should be noted that since the market beta equals 1, the

expected market return is equal to the sum of the

CAPM risk premium and the

risk free rate. The CAPM requires that the flows that help make up the expected returns are mathematical expectations. If this is not the case, then the

cost of capital required to discount cash flows forecasts is different from the expected return.

Firm cash flow : FCF (unlevered cash flow or cash flow from operations). Unlike

equity cash flow, this is calculated without taking into account after-tax financial expenses or the change in net debt. FCF is discounted at the

WACC rate in a DCF model. It is also used in the

APV approach.